Elsalam Aleilkom my dear brothers and sisters,

I am very sorry for not replying to so many emails sent to me in the last few months.

I realize how many people are so confused about the future. I wish to help clarify this confusion once and for all.

Lets first start talking briefly about the USA.

You all have understood the mortgage sub-prime crisis and why financial

institutions lost trillions of $. But now, the USA and the West in

general are in recession. This recession will last at least for 2

years. This will coincide with Obama getting some of the US troops out

of Iraq and lowering US defense budget. Bush overspent on his military

failures and the American people are now paying the price. This will

also coincide with the USA government following a Keynesian policy with

huge civilian spending. I actually expect the whole world to be

keynesian.

Why

today the US$ keeps appreciating when the US economy is in recession?

The answer is simple: The US is selling tons of assets all over the

world to handle its current liquidity shortage. They must sell in

emerging markets as they lost more in the US and must re-balance their

portfolio. Once they sell those assets, they must exchange the local

currency like EGP to US$ which create more demand for US$ and therefore

the US$ is appreciating against most currencies at this current time.

However,

once they finish selling most of their assets overseas, you will see

the US$ going down again like you have never seen it before. I

personally expect the US$ to reach 4 EGP within the next 2 years. The

Americans will have to deppreciate their currency to attract investors,

increase exports and pay off the huge debts they have. They will flood

the world with US$ so sell your dollars at the peak and forget about the dollar for the next 2 years.

If you like following US markets, follow GE and Google and pharmaceuticals.

What about emerging markets?

The

emerging economies that depend on exportation to grow will suffer.

Other economies with domestic and external growth like China will slow

down but will still grow. They key word here is domestic consumption.

China has a new middle class that is consuming like never before. China

alone has 200 millions Chinese middle class and growing every day like

plants. China can now make any medium car better than any Europeans,

Americans but at lesser price. In the future, you either produce high

quality products or China will terminate you out of the market.

What about Egypt? Make attention to this:

Egypt

grew in the last few years from an organic growth. This means that 80%

of our GDP growth is due to Egypt and Egyptians consuming locally. Only

20% is due to exportation. 70% of investments came from Egyptians and

30% from Arabs and Foreigners.

Make even more attention to this:

The

cause of the growth of the Egyptian economy in recent years is the

demography. You see, after Egypt made peace with Israel in 1979,

Egyptians started getting married alot and making lots of babies. This

is called a baby boom. Those kids are growing and today, you have a

huge young population in Egypt. Unfortunately half of them have no

education so they don't feel any growth or improvement. However, we see

others who are well educated, hard workers and smart. They work for

large firms like Mobinil, Orascomates, Ezz, Raya call centers, etc.

They work in Banks, brokerage, Oil, services and tourism, etc. Those

people make good income to shop at City Stars, dine out and blow their

mobile phone bills. Those kids need to get married, buy a home and all

what come with it. Today still, 1 millions babies are born every year.

You can see the power of this generation in the real estate deficit we

see in Egypt, especially middle class real estate.

We

have at least 10 million Egyptians making enough income to keep the

economy growing. In 10 years, we will have 25 millions Egyptians with

high purchasing powers. Egypt will continue to grow due to its young

population and a new consumption culture that is very profitable for

capitalism. (I do not approve this culture but this is a different

subject)

There

is no doubt that Egypt's growth will slow down during 2009. Instead of

6-7% growth rate, we will see 5-6% growth rate. But some sectors will

experience higher growth rate than others naturally. Only Allah knows

the future. In theory, tourism should slow down a little but who knows?

Couldn't we be cheaper and more competitive than other countries and

compete better in this crisis environment? Could we get more tourists

instead of less? Can this be applied to textile which is expected to

suffer from low Imports from Europe? Can we make better cloths at

cheaper prices? Can we find new markets? The price of fertilizers

deppreciated but Egyptian companies still sell it with a profit due to

low cost. You all must study each stock on its own and decide if it

will suffer or gain from this relative slow down.

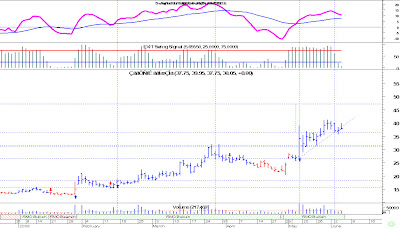

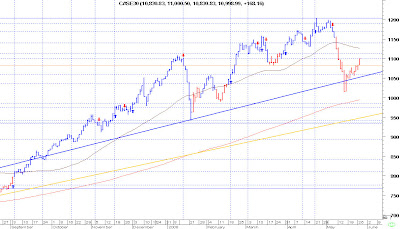

What about the Egyptian stock market?

We

should still see the stock market appreciate soon. Why? First because

any crash should correct 40% up but mainly because the market crashed

way too much and the prices of so many stocks are now so devaluated

that no slow down can justify it.

Now,

investing will be harder. You must buy very low P/E stocks and be very

selective. It is not about past earnings but about 2009-2010 earnings.

If you feel your investment will do well, then hold it, buy more. If

you feel it will suffer, then sell it and buy more of the one that will

perform well. In other words, every investor should concentrate his

portfolio in 4-5 stocks maximum and they better be the best of the best

and well diversified..

Please

realize that capitalism is not dead and considering socialism is a

waste of time. I don't believe Islam is the solution but I believe that

the solution is in Islam. Don't waste your time considering consipracy

theories about the Jews and Israel. You give them more importance than

they deserve. As far as I am concerned, and with all respects to my

Jews cousins, they are ants and the world is an elephant. 20 millions

Jews in the world can't crash a market, especially when they lose with

everybody.

The

world might seem crashing but Elhamd Lellah, food prices are going down

so that so many poor people on earth can eat and not starve to death. I

expect the Egyptian central bank to lower interest rate soon. Inflation

is a huge problem and it is the only real threat to the economy.

Unfortunately, I believe that Food, oil and metals prices will increase

again but not as much as before. Follow the Chinese and the Indian as

they are boomingll! China during a recession in the USA is expecting 9%

growth instead of 10% growth!!! Amazing!

If you are an investor, don't be scared. Invest and insha'Allah we make good return in the near future. Follow the 100 and 200 days moving average and you will know when to sell.

Remember: the formula of success is:

Work hard + knowledge + ethics = success.

Success is from Allah alone and Allah will never bless gambling or arrogance.

Our

world is changing. Aren't you surprised and sad about the trillions of

$ that the world lost? This could have fed Africa and Asia alltogether

for the next 20 years.

Warren Buffet told Americans " It is time to buy corporate America".

I say: "It is time to buy Corporate Egypt".

When

you buy, you buy gradually over days or weeks depending on the market.

Buy with your brain not with your heart. Don't follow the market but

rather act before the market.

I

expect and hope that we are at bottom. Buy 50% less than book value and

70% below fair value. Remember, we are looking at the future not the

past. I hope I am clear about that.

Finally,

if you ask someone to help you invest or trade, you must be intelligent

and ask someone who is successful. In other words, anybody who lost

money in the stock market while trading stocks should just stay quit

and help himself/herself first before helping others.

I sincerely wish you all success, prosperity and good health.

Elhamd Lellah for everything.

Gasser Shehata