Wednesday, May 28, 2008

Monday, May 19, 2008

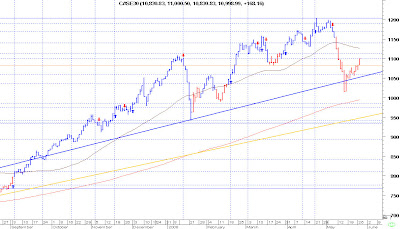

Case30 19May2008

- The index dropped bellow 50 days WMA and 200 days WMA.

- A small rebound in ONE day failed to close above my important resistance 10,600.

- Tomorrow will show the real intention of the CASE index.

- Failing to close above the 10,602 will mean I will SELL the market until a proper rebound near the 9750 ~ 9800 range.

- This will mean the market is NOT in an up-trend short.

- Swingers are the ONLY players with caution; bears are ruling short.

Tuesday, May 13, 2008

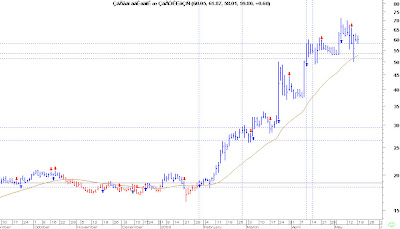

OCIC 13May2008

- I am writing this before 183th may session

- The stock penetrated the RMO previous confirmed buy signal.

- The next support is 368.

- If one should see a rebound from this point (hopefully), a quick buy is recommended targeting 410.

- The stock should re-test the broken 410 support to confirm it as a broken support, and declare a known resistance point.

- Take extra care when dealing with this stock the coming day.

- Medium terms and RMOs should NOT enter unless 410 is penetrated UP

Support points - Falling Securities - Rebound session expected

- OCIC: 387 (Broken and confirmed) then 367 (solid - not tested)

- ACGC: 12 (solid - stop loss) broken, then 11.38 solid (Tested and stock rebound)

- The above levels are wide and been accomplished by gapping, so penetrating 12 is really dangerous.

- ACGC is still good and is expected to boom, I am just taking benefit of swings. (A nice piece of news was generated yesterday concerning an investment profitable sell)

- EGTS: Accumulation point above 8.35 (solid), I am expecting a break through 9LE to new levels soon

- The above security broke the support level, but need confirmation of the break - too bad)

- GGCC: Straight uptrend 1st resistance 90LE - Stop loss bellow 80 and NOT reached

- ORTE: The offer @ 83 is due wednesday

- ACGC: 12 (solid - stop loss) broken, then 11.38 solid (Tested and stock rebound)

- The above levels are wide and been accomplished by gapping, so penetrating 12 is really dangerous.

- ACGC is still good and is expected to boom, I am just taking benefit of swings. (A nice piece of news was generated yesterday concerning an investment profitable sell)

- EGTS: Accumulation point above 8.35 (solid), I am expecting a break through 9LE to new levels soon

- The above security broke the support level, but need confirmation of the break - too bad)

- GGCC: Straight uptrend 1st resistance 90LE - Stop loss bellow 80 and NOT reached

- ORTE: The offer @ 83 is due wednesday

Monday, May 12, 2008

Support points - Falling Securities

- OCIC: 387 then 367 (solid)

- ACGC: 12 (solid - stop loss), then 11.38 solid

- The above levels are wide and been accomplished by gapping, so penetrating 12 is really dangerous.

- ACGC is still good and is expected to boom, I am just taking benefit of swings.

- EGTS: Accumulation point above 8.35 (solid), I am expecting a break through 9LE to new levels soon

- GGCC: Straight uptrend 1st resistance 90LE

- ORTE: The offer @ 83 is due wednesday

- ACGC: 12 (solid - stop loss), then 11.38 solid

- The above levels are wide and been accomplished by gapping, so penetrating 12 is really dangerous.

- ACGC is still good and is expected to boom, I am just taking benefit of swings.

- EGTS: Accumulation point above 8.35 (solid), I am expecting a break through 9LE to new levels soon

- GGCC: Straight uptrend 1st resistance 90LE

- ORTE: The offer @ 83 is due wednesday

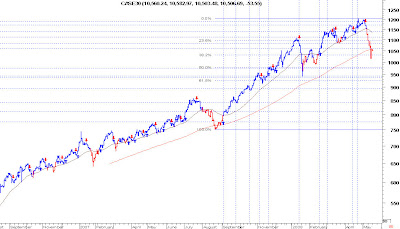

CASE30 12May2005

- The market is declining for the past 4 sessions

- 1st support point (RMO) is 11,133

- 2nd support point would be 10,890

- Both above points are solid points.

- OCIC bad performance is really affecting CASE30.

- 1st support point (RMO) is 11,133

- 2nd support point would be 10,890

- Both above points are solid points.

- OCIC bad performance is really affecting CASE30.

Thursday, May 08, 2008

EGTS 08May2008

- Buy aggressively slightly above 8.50LE

- This area is growing a very solid support point every single week.

- Target 14LE in the near future.

- The pop-up is NOT speculated to be soon though. Speculating the timing is NOT so easy for me.

- I think wave analyzers will generate more accurate speculations of how near is the pop-up is.

- I would still accumulate on 8.50 level.

- Stop loss 8.38 (but be-ware of sellers traps during market corrections)

- This area is growing a very solid support point every single week.

- Target 14LE in the near future.

- The pop-up is NOT speculated to be soon though. Speculating the timing is NOT so easy for me.

- I think wave analyzers will generate more accurate speculations of how near is the pop-up is.

- I would still accumulate on 8.50 level.

- Stop loss 8.38 (but be-ware of sellers traps during market corrections)

ACGC 08May2008

- I expect a rebound of 12.50 (if reached).

- I recommend an aggressive buy upon any for casted rebound.

- Still in uptrend

- settlement above 12.95 for a week will build a very stable support point for higher prices in future.

- I recommend an aggressive buy upon any for casted rebound.

- Still in uptrend

- settlement above 12.95 for a week will build a very stable support point for higher prices in future.

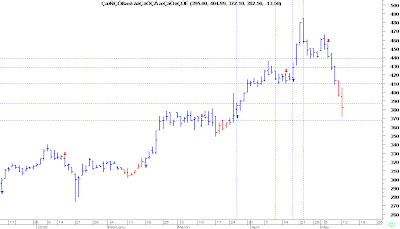

OCIC 08May200

- The active swing traders was forced to profit gain @ 440LE

- Stop loss points should be 410LE

- The security is severely affecting the CASE30 index.

- I have seen sell power within the security during past 3 sessions.

- Still in up-trend in ALL frames (no intraday).

- Watch out for the stop loss point.

Subscribe to:

Posts (Atom)