Saturday, September 13, 2008

Sunday, July 20, 2008

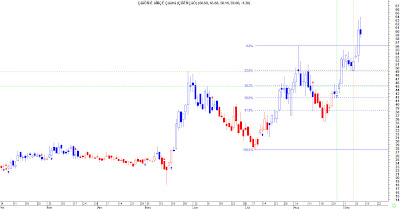

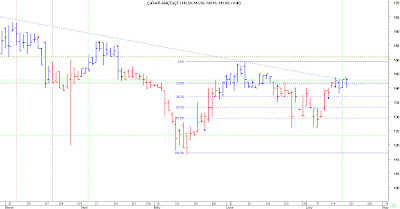

SWDY 20Jul2008 - Sweedy Cables - Buy

- Low volume

- RMO confirmed buy signal @ 142.7 , stop loss @ 139.82

- The close = last trade confirmed > signaled buy price.

- Over Bought, the stock needs to hold its position for three days or so.

- The stock confirmed the reversal from the short term down-trend it previouslt conformed to.

- I would buy this stock, and re-buy when it drops from the over bought area on K%(14,5)

Monday, June 30, 2008

Market condition 30Jun2008

- Prices are very appealing.

- We are still in an UPTREND.

- We would NOT want to penetrate the 9800 point on CASE30 that would lead to panic, hence sharper decline within the market prices.

- June29th, some funds entered the market picking up some stocks @ critical support points.

- If this was an artificial support as usual, then it will fail today.

- Many are expecting to have good market conditions after the July 1st day off.

- Many who has left the market earlier will NOT re-enter the market unless penetrated the 11, 124 !

- Bellow the above level, all will be swing trading and NOT holding for nay reason, thus give the market real harsh days.

- We should all carefully monitor our stop loss points.

Wednesday, June 04, 2008

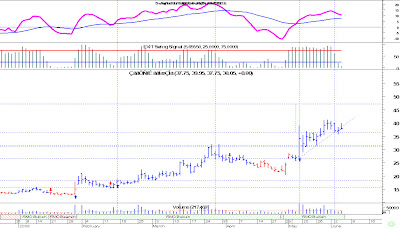

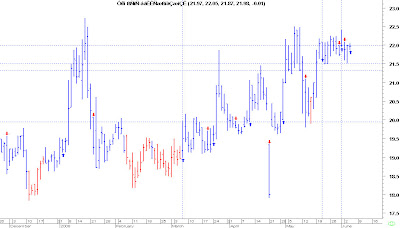

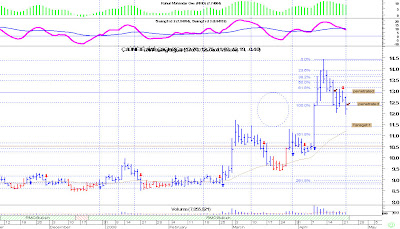

SKPC 04Jun2008 Sidi Kreir Petrochemicals Company

- Sidi Kreir security.

- Too many buy signals.

- Candles shortenning JUST bellow 21.98LE

- I would buy in the current level, stop loss @ 21.50LE

- Company working in the chemical field.

- Too many rumers, the main is that a brokerage company is dominating the security (fools).

- I expect a penetration to 22LE is coming soon isa.

- After penetration the road is OPEN.

Wednesday, May 28, 2008

Monday, May 19, 2008

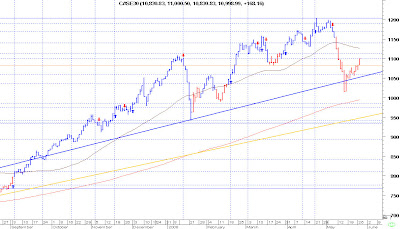

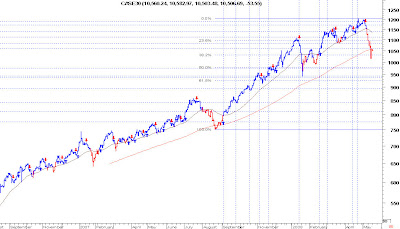

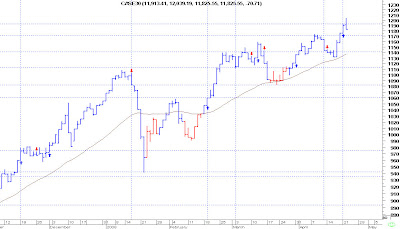

Case30 19May2008

- The index dropped bellow 50 days WMA and 200 days WMA.

- A small rebound in ONE day failed to close above my important resistance 10,600.

- Tomorrow will show the real intention of the CASE index.

- Failing to close above the 10,602 will mean I will SELL the market until a proper rebound near the 9750 ~ 9800 range.

- This will mean the market is NOT in an up-trend short.

- Swingers are the ONLY players with caution; bears are ruling short.

Tuesday, May 13, 2008

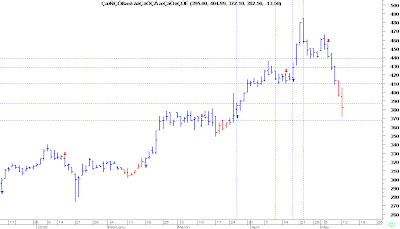

OCIC 13May2008

- I am writing this before 183th may session

- The stock penetrated the RMO previous confirmed buy signal.

- The next support is 368.

- If one should see a rebound from this point (hopefully), a quick buy is recommended targeting 410.

- The stock should re-test the broken 410 support to confirm it as a broken support, and declare a known resistance point.

- Take extra care when dealing with this stock the coming day.

- Medium terms and RMOs should NOT enter unless 410 is penetrated UP

Support points - Falling Securities - Rebound session expected

- ACGC: 12 (solid - stop loss) broken, then 11.38 solid (Tested and stock rebound)

- The above levels are wide and been accomplished by gapping, so penetrating 12 is really dangerous.

- ACGC is still good and is expected to boom, I am just taking benefit of swings. (A nice piece of news was generated yesterday concerning an investment profitable sell)

- EGTS: Accumulation point above 8.35 (solid), I am expecting a break through 9LE to new levels soon

- The above security broke the support level, but need confirmation of the break - too bad)

- GGCC: Straight uptrend 1st resistance 90LE - Stop loss bellow 80 and NOT reached

- ORTE: The offer @ 83 is due wednesday

Monday, May 12, 2008

Support points - Falling Securities

- ACGC: 12 (solid - stop loss), then 11.38 solid

- The above levels are wide and been accomplished by gapping, so penetrating 12 is really dangerous.

- ACGC is still good and is expected to boom, I am just taking benefit of swings.

- EGTS: Accumulation point above 8.35 (solid), I am expecting a break through 9LE to new levels soon

- GGCC: Straight uptrend 1st resistance 90LE

- ORTE: The offer @ 83 is due wednesday

CASE30 12May2005

- 1st support point (RMO) is 11,133

- 2nd support point would be 10,890

- Both above points are solid points.

- OCIC bad performance is really affecting CASE30.

Thursday, May 08, 2008

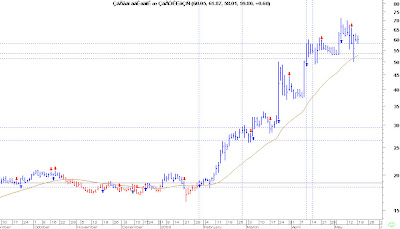

EGTS 08May2008

- This area is growing a very solid support point every single week.

- Target 14LE in the near future.

- The pop-up is NOT speculated to be soon though. Speculating the timing is NOT so easy for me.

- I think wave analyzers will generate more accurate speculations of how near is the pop-up is.

- I would still accumulate on 8.50 level.

- Stop loss 8.38 (but be-ware of sellers traps during market corrections)

ACGC 08May2008

- I recommend an aggressive buy upon any for casted rebound.

- Still in uptrend

- settlement above 12.95 for a week will build a very stable support point for higher prices in future.

OCIC 08May200

- The active swing traders was forced to profit gain @ 440LE

- Stop loss points should be 410LE

- The security is severely affecting the CASE30 index.

- I have seen sell power within the security during past 3 sessions.

- Still in up-trend in ALL frames (no intraday).

- Watch out for the stop loss point.

Tuesday, April 29, 2008

ORTE related ( Mobile Banking)

ArabFinance:

National Telecom Regulatory Authority (NTRA) is looking into providing

licenses for Mobile banking after its popular success in more than one

local and international bank.

Dr.Amr Badawi,Executive Manager of

NTRA said that a team is working with Central Bank Of Egypt (CBE) To

determine the necessary framwork to organize the licensing of this new

service.

He added that the main reason for this step is the increased activity of mobile banking providers recently.

He said that Mobile Banking in Egypt now consists of balance information plus Credit Card transactions.

It is worth noting that METCO communications leads in Mobile banking,its

ventures include National Bank Of Egypt (NBE),National Societe General

Bank (NSGB),Piraeus Bank, Credit Agricole,National Bank and Banque

Misr. HSBC is run by a central system operation from Hong Kong and Citi

Bank is run through a similar system from london.

Orascom Telecom has already announced its drive to establish a company specialized in Mobile Banking and money transfering.

Tuesday, April 22, 2008

CASE30 22Apr2008

- CASE30 has generated a buy signal yesterday intending to move up.

- I would have bought the index @ 11,902 and stop loss pointed @11,705

- This is a very optimistic point of view, that I personally still in the "NOT believing" stage.

- One will see wonders the coming days, especially that the famous Orascoms (ORTE, and OCIC) are swinging fast.

- OCIC somehow reminds me of the swings just BEFORE the announcement of Lavarge scheme.

- ORTE is ALREADY playing games after the intention to buy around 10% of the market with 83LE (market price was 75LE)

- ONE may say that he is already SELLING, or making way for WIND (partner- Mr. Nagib already chairman) to sell with a better price within our market.

- I have no comment for the above quote.

- Technically, I would still buy the index, and act accordingly and watch the 11,705 point.

- Needless to say that the 11,500 point is now stronger, and now have the 50 days moving average supporting this point.

ACGC 22Apr2008

- ACGC penetrated the 12.90LE DOWN

- ACGC penetrated the 12.34 LE DOWN

-

ACGC is really targetting 11.50LE "Target 1"

ACGC is really targetting 11.50LE "Target 1"- Estimates:

- As I already stated before, upon penetration of the 12.90LE support, the security may rebound on 11.50LE and swing between 11.50 ~ 12.34 or 12.90 (Circled in graph), which will be profitable for many (9% or more).

Monday, April 21, 2008

ASCM 21Apr2008

-ASCM is now accumulating above a good support point.

- The security is showing high volumes.

- The major trend is up.

- The short term is sideway.

- Very risky to break down the 200LE level

- Still, investors are obliged to accumulate within this Febo level (38% level)

- RMO traders will NOT enter the security until 235 level penetrated upward.

- Swingers will trade the sideway 200 ~ 234LE range 17%

- The security is known to move UP fast intra-day level, yet very slow for EOD traders.

OCIC 21Apr2008

- The security is hitting new targets every day

- Volumes was high during the accumulation period BEFORE every move up.

- The money flow index still has some to offer, and NOT in a danger zone.

- The stockastic is NOT over bought yet, so the way should be clear to higher levels.

- According to Febonacci projection levels, I am targeting settlement over the 50% level (452LE)

- Or maybe a settlement over the 61.8% (470LE)

- This security is heaven for RMO traders, then next three months is expected to be really good for the security holders.

Let us wait and see